Is this not the most undervalued stock?

Investing for me, is about looking for great businesses. This however does not apply to everyone. Some may just want to search for companies that are undervalued to its book value. I do not specifically seek for those stocks. What I usually look for is a business which I can understand, comfortable with. Those that I can see and understand the potential - but those stocks may not be the most undervalued. In fact, it may not be undervalued at all, but as in business, you do not seek for just undervalue but good valuable companies is what you seek.

Most good businesses are usually not undervalued. Good businesses are usually trading at fair value. Seldom are we able to get them at prices which is way undervalued unless, we found those companies at its early stage.

To judge a company's undervaluation based on book value though, it is much easier. A company that is trading at below its book value (with some margin of safety) is presumed to be undervalued. This applies to one particular stock which I am going to introduce as below - Insas Berhad.

Is it not one of the most undervalued company by Price / Book Value - trading at 34.61% of its total book value?

If it is so undervalued, why is it then trading at such a valuation? No dividends, perhaps. The company in fact declared its first ever dividend of 1.3 sen last year.

Or more so the controlling parties, are contented (with what already have). To address the low price / NA, the management do actually some shares buyback - and in fact for certain period, they were aggressively buying back their shares. But those shares bought back were redistributed back to the shareholders in the form of share dividends - which makes me wonder on why do they do that. (I however feel that their buying back is the right thing to do rather than dividends.)

In terms of performance, as it mainly is an investment holding company in the areas of business which is very cyclical - stocks investment (marked to the fair value of investment), stock broking, some property investments, several IT related businesses, no one seems to be able to foresee what are the prospects or future profitability of these businesses. However, the management did manage to create value (albeit not fantastic) as shown in the growth of its total assets and equity below.

Frankly, I would not judge the company to be poorly run, but it is one of those companies which are just inaggressive where the controlling parties are just too contented with what they have. Once a while, they would have made some good investments as shown below, but these returns are kept at the group level and not shared with shareholders (usually in the form of dividends).

One of the scenario which shows that the management have done some great work is as per below where the company has gained 80% over 3 years. These investments however are the ones which only comes once a while, and will not be contributing consistently to the company.

Part of the statement in Annual Report 2010

Last year, we reported that we made a sizeable investment in London in Chantrey House, a residential cum commercial property in the Belgravia area, a prime property location in central London. In conjunction with our UK partner, we took an equal interest in the investment amounting to 22.5 million British Pounds. Since we purchased that property, central London property prices have recovered strongly. Current prices for apartments in comparable locations are transacting at between 1,200 to 1,400 Pounds per square feet compared to our purchase price of 670 Pounds per square feet. We intend to hold on to this investment as we believe property prices should continue to rise in view of the low interest rate environment.

Part of the statement in Annual Report 2012

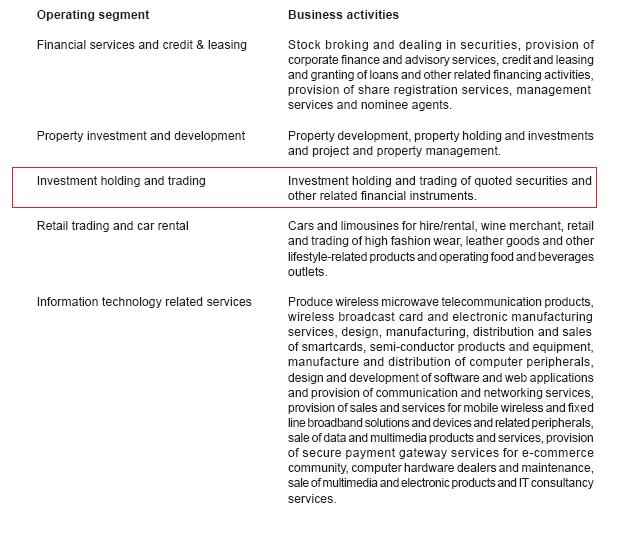

What is Insas core businesses then and where is its revenue and profit contribution from? Its main involvement is in the investment holding, trading and financial services and credit (money lending), and leasing (as shown below):

Investment holding as highlighted below is what they do with their cashflow, which means they trade stocks as well as buying bonds and other financial instruments:

Besides stockbroking, money lending and investments into several businesses, one noticeable investment is its associate stake in Inari, a semiconductor company which is doing decently well. The company as announced is to move from its ACE listed status to Main Board yesterday. On paper, Insas' holding of 35% + warrants in Inari is already worth RM140 million as at 9 July 2013. Are we saying the remaining businesses and assetsin Insas' stable are worth the remaining RM210 million?

For most part of its businesses, Insas are involved in mostly cash related trades (or businesses) which means they are liquid traded assets, hence the company should not be trading at that much below its NTA. It is not really a property company in which case the landbank may take a longer time to be disposed.

As many would have thought though (including me), Insas has been trading that way for ages, and the management is not going to change its way of handling the company. Currently, Insas has about 33,000 shareholders which means there are quite a number of holders whom are caught holding the stock for a very long time.

I however do not think the management has taken the shareholders for a ride but they are surely not doing enough to take care of minorities interests

Most good businesses are usually not undervalued. Good businesses are usually trading at fair value. Seldom are we able to get them at prices which is way undervalued unless, we found those companies at its early stage.

To judge a company's undervaluation based on book value though, it is much easier. A company that is trading at below its book value (with some margin of safety) is presumed to be undervalued. This applies to one particular stock which I am going to introduce as below - Insas Berhad.

Is it not one of the most undervalued company by Price / Book Value - trading at 34.61% of its total book value?

If it is so undervalued, why is it then trading at such a valuation? No dividends, perhaps. The company in fact declared its first ever dividend of 1.3 sen last year.

Or more so the controlling parties, are contented (with what already have). To address the low price / NA, the management do actually some shares buyback - and in fact for certain period, they were aggressively buying back their shares. But those shares bought back were redistributed back to the shareholders in the form of share dividends - which makes me wonder on why do they do that. (I however feel that their buying back is the right thing to do rather than dividends.)

In terms of performance, as it mainly is an investment holding company in the areas of business which is very cyclical - stocks investment (marked to the fair value of investment), stock broking, some property investments, several IT related businesses, no one seems to be able to foresee what are the prospects or future profitability of these businesses. However, the management did manage to create value (albeit not fantastic) as shown in the growth of its total assets and equity below.

Frankly, I would not judge the company to be poorly run, but it is one of those companies which are just inaggressive where the controlling parties are just too contented with what they have. Once a while, they would have made some good investments as shown below, but these returns are kept at the group level and not shared with shareholders (usually in the form of dividends).

One of the scenario which shows that the management have done some great work is as per below where the company has gained 80% over 3 years. These investments however are the ones which only comes once a while, and will not be contributing consistently to the company.

Part of the statement in Annual Report 2010

Last year, we reported that we made a sizeable investment in London in Chantrey House, a residential cum commercial property in the Belgravia area, a prime property location in central London. In conjunction with our UK partner, we took an equal interest in the investment amounting to 22.5 million British Pounds. Since we purchased that property, central London property prices have recovered strongly. Current prices for apartments in comparable locations are transacting at between 1,200 to 1,400 Pounds per square feet compared to our purchase price of 670 Pounds per square feet. We intend to hold on to this investment as we believe property prices should continue to rise in view of the low interest rate environment.

Part of the statement in Annual Report 2012

I am also pleased to report that subsequent to year end, our 50% joint-controlled entity has accepted offer to sell the London’s Chantrey House property for £37.6 million, and the sale price represents a 80% capital appreciation over our original acquisition price 3 years ago. The sale, when completed, will generate free cashflow in excess of RM50 million to Insas.

What is Insas core businesses then and where is its revenue and profit contribution from? Its main involvement is in the investment holding, trading and financial services and credit (money lending), and leasing (as shown below):

Investment holding as highlighted below is what they do with their cashflow, which means they trade stocks as well as buying bonds and other financial instruments:

Besides stockbroking, money lending and investments into several businesses, one noticeable investment is its associate stake in Inari, a semiconductor company which is doing decently well. The company as announced is to move from its ACE listed status to Main Board yesterday. On paper, Insas' holding of 35% + warrants in Inari is already worth RM140 million as at 9 July 2013. Are we saying the remaining businesses and assetsin Insas' stable are worth the remaining RM210 million?

For most part of its businesses, Insas are involved in mostly cash related trades (or businesses) which means they are liquid traded assets, hence the company should not be trading at that much below its NTA. It is not really a property company in which case the landbank may take a longer time to be disposed.

As many would have thought though (including me), Insas has been trading that way for ages, and the management is not going to change its way of handling the company. Currently, Insas has about 33,000 shareholders which means there are quite a number of holders whom are caught holding the stock for a very long time.

As for its future, as long as it is into businesses of investing and stockbroking, it will continue to be the same i.e. pretty volatile. I feel that for it to move upwards i.e. closer to its Net Aset Value, the minority investors have to do something and voice out more so that the management take heed over the voices of the masses. Only then will it trade at its real value.

I however do not think the management has taken the shareholders for a ride but they are surely not doing enough to take care of minorities interests

No comments:

Post a Comment