source: [Bursa Malaysia Stock Market Analysis Digest]

Malaysian Oil & Gas - A Closer Look At “Package A”

Package A Tender: Who could emerge the winner(s)?

Who could emerge the winner(s)? Based on our assessment of PETRONAS’ Pan Malaysia transportation and installation (T&I) Package A, we expect Alam Maritim and Barakah to be the front runners. The former’s edge is in owning the most complete marine spread among its peers. The latter meanwhile has the advantage of having the finest pipelay barge (age profile, asset quality etc). While Puncak Niaga O&G is the incumbent, we reckon its focus is on Package B. We are BUYersof Alam Maritimand Barakah.

Who could emerge the winner(s)? Based on our assessment of PETRONAS’ Pan Malaysia transportation and installation (T&I) Package A, we expect Alam Maritim and Barakah to be the front runners. The former’s edge is in owning the most complete marine spread among its peers. The latter meanwhile has the advantage of having the finest pipelay barge (age profile, asset quality etc). While Puncak Niaga O&G is the incumbent, we reckon its focus is on Package B. We are BUYersof Alam Maritimand Barakah.

Oil&Gas: Summary of Recommendation

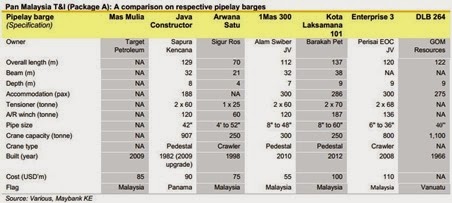

Bidders for PETRONAS’ T&I Package A. The market’s interest in PETRONAS’ Pan Malaysia T&I Package A contract is heating up. The Package A tender, open only for local players, is likely being pursued by at least seven names, we understand, i.e. Alam Maritim, Barakah, Perisai, Puncak Niaga, SAKP, Sigur Ros and Target Energy.

Bidders for PETRONAS’ T&I Package A. The market’s interest in PETRONAS’ Pan Malaysia T&I Package A contract is heating up. The Package A tender, open only for local players, is likely being pursued by at least seven names, we understand, i.e. Alam Maritim, Barakah, Perisai, Puncak Niaga, SAKP, Sigur Ros and Target Energy.

Package A’s requirement. Based on Upstreamonline, the tender calls for pipelay barge(s) with lifting capacity of 250-300 tonnes with pipelaying works of 80-100km p.a.. Based on our reference checks with the competing bidders, (i) the marine spread makes up 40%-80% of the contract value (i.e. MYR2-3b), and (ii) the day rate is capped at MYR900k (USD285k) to cover the cost of one pipelay barge, two 5,000bhp AHTS, two supply vessels, two crewboats, one supply crew boat and one diving support vessel (optional) as well as fuel, crew and diving equipment costs.

Key factors to improve the hit rate. Having a fully-owned Malaysia flagged pipelay barge that is relatively young, is an advantage. Most of the bidders comply with the former except for Alam’s 1Mas 300 unit (a 51:49 JV with Swiber).Nonetheless, Alam has the most complete marine spread vis-à-vis its peers (most of the OSV charters are on 3rd party basis), and this works to its advantage. Ultimately, an operational track record in pipelay works and competitive tender pricing would be among the main criterias to improving the prospect of winning the job.

Package A could generate net profit of >MYR60m p.a..Puncak Niaga (via GOM Resources and KGL Ltd) is the incumbent for the existing contract. Strictly based on its segmental annual report, its O&G division reported revenue and net profit of MYR290m/MYR778m and MYR15m/MYR63m in 2011/12 respectively, of which the bulk comes from the Pan Malaysia T&I works. While Puncak Niaga O&G is the incumbent, we gather that its focus for this upcoming tender is on Package B. Meanwhile, SAKP’s targetis on Package C, D and E.

Key factors to improve the hit rate. Having a fully-owned Malaysia flagged pipelay barge that is relatively young, is an advantage. Most of the bidders comply with the former except for Alam’s 1Mas 300 unit (a 51:49 JV with Swiber).Nonetheless, Alam has the most complete marine spread vis-à-vis its peers (most of the OSV charters are on 3rd party basis), and this works to its advantage. Ultimately, an operational track record in pipelay works and competitive tender pricing would be among the main criterias to improving the prospect of winning the job.

Package A could generate net profit of >MYR60m p.a..Puncak Niaga (via GOM Resources and KGL Ltd) is the incumbent for the existing contract. Strictly based on its segmental annual report, its O&G division reported revenue and net profit of MYR290m/MYR778m and MYR15m/MYR63m in 2011/12 respectively, of which the bulk comes from the Pan Malaysia T&I works. While Puncak Niaga O&G is the incumbent, we gather that its focus for this upcoming tender is on Package B. Meanwhile, SAKP’s targetis on Package C, D and E.

Award to be announced soon? We highlight two scenarios. The most talked would be an imminent announcement by end-2013 or early 2014. Alternatively, PETRONAS could defer the award and instead exercise the 1-year extension of the current contract in 2014. While we expect a sole winner for this job, we do not rule out the possibility of PETRONAS dividing the Package A into three geographical areas i.e. Peninsular M’sia, Sabah, Sarawak, to expedite the pipe-laying works.

Oil & Gas Companies: Peer Valuation Summary (click to enlarge):

Assessment and comments

Cost Alam would likely have the most comprehensive marine spread cost advantage. Unlike its peers, Alam could use its own OSVs. Its pipelay barge is by far the cheapest, which aids in putting in a competitive DCR. The minor disadvantage is that the pipelay barge is51%-owned. Majority of its peers units are wholly owned

Cost Alam would likely have the most comprehensive marine spread cost advantage. Unlike its peers, Alam could use its own OSVs. Its pipelay barge is by far the cheapest, which aids in putting in a competitive DCR. The minor disadvantage is that the pipelay barge is51%-owned. Majority of its peers units are wholly owned

Asset quality (pipelay barge) Barakah’s unit is arguably the youngest and potentially has the best operating specification. It can be upgraded to derrick lay barge status of up to 1,500 tonne crane without major structural change. It has proven to be operationally reliable, stable and sizeable,with huge deck space. Puncak Niaga’s DLB 263 is arguably the oldest: built in 1966.

Track record Puncak Niaga (package A) and SAKP are the incumbents for the Pan Malaysia T&I jobs. Perisai’s Enterprise 3 was on a bare boat charter to SAKP at USD1.9m/ month (DCR: USD63k). Barakah’s KL 101 is currently deployed as an accommodation barge to Pertamina up to Nov 2013 at DCR of USD50k